EDUCATIONAL IMPROVEMENT TAX CREDIT PROGRAM

The Pennsylvania Educational Improvement Tax Credit Program is administered by the state Department of Community and Economic Development (DCED) under Act 48. Established in 2001, the program awards tax credits to businesses that make contributions to Scholarship Organizations (SOs) and/or Educational Improvement Organizations (EIOs) that are on a list approved and published by DCED.

The Uptown Music Collective actively pursues Educational Improvement Tax Credit (EITC) dollars from approved businesses. As an EIO, the Uptown Music Collective is recognized as a nonprofit organization that offers Innovative Educational Programs, or “an advanced academic or similar program that is not part of the regular academic program of a public school but that enhances the curriculum or academic program of the public school.”

Thanks to local and area businesses, more than $37,000 has supported UMC programs, such as Discovering Music and STOMP, and the lessons, classes and workshops that ultimately lead to the highly-recognized Performance Program through the EITC program since 2021!

Thank you to the following EITC business donors that have contributed to the Uptown Music Collective!

- Woodlands Bank

- UPMC Health Plan

- Jersey Shore State Bank

- Fulton Bank

- PPL Electric Utilities

- C&N

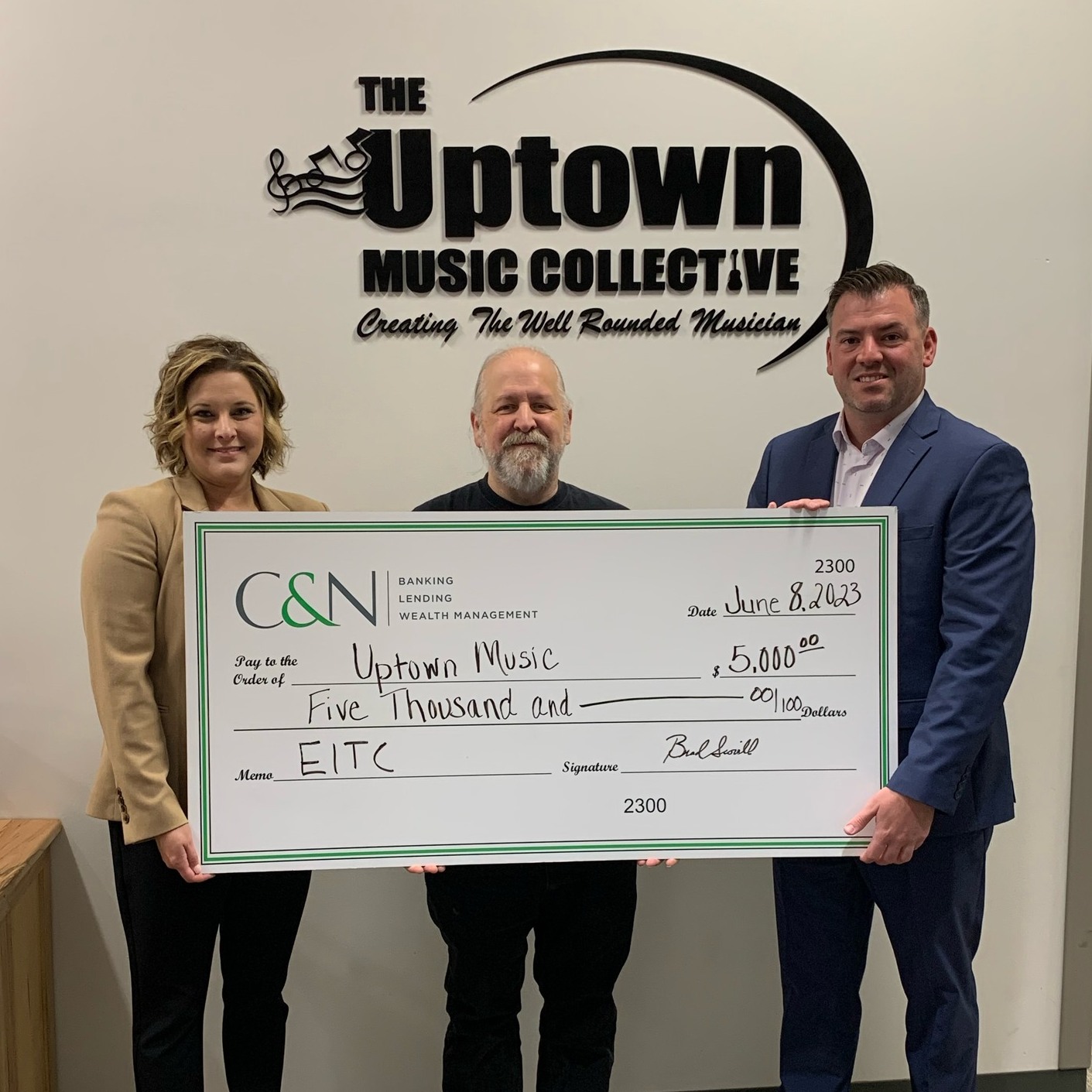

The Uptown Music Collective received a $5,000 donation from C&N as part of the Educational Improvement Tax Credit (EITC) program. UMC programs, such as Discovering Music and STOMP, and the lessons, classes and workshops that ultimately lead to the highly-recognized Performance Program all demonstrate the school’s innovative and enriching methods. Pictured, from left, are Michelle M. Reidinger, C&N Regional Retail Banking Manager; Dave Brumbaugh, UMC Executive Director; and Adam Dincher, C&N VP/Senior Commercial Lending Relationship Manager.

EITC contributions can be made directly to the Uptown Music Collective. Any business interested in donating through the EITC program should contact Adrienne Wertz, Development Coordinator, at [email protected].

THANK YOU TO ouR EITC BUSINESS Donors

2022

Woodlands Bank Contributes $4,375 to the Uptown Music Collective as Part of EITC Initiative.

The Uptown Music Collective recently received a $4,375 donation from Woodlands Bank as part of the Educational Improvement Tax Credit (EITC) program, as well as an additional $625 general donation. Pictured, from left, are Jon Conklin, President & CEO, Woodlands Bank; Dave Brumbaugh, Executive Director, Uptown Music Collective; Adrienne Wertz, Development Coordinator, Uptown Music Collective; and Matt Gottschall, Downtown Williamsport Office Manager, Woodlands Bank.

2022

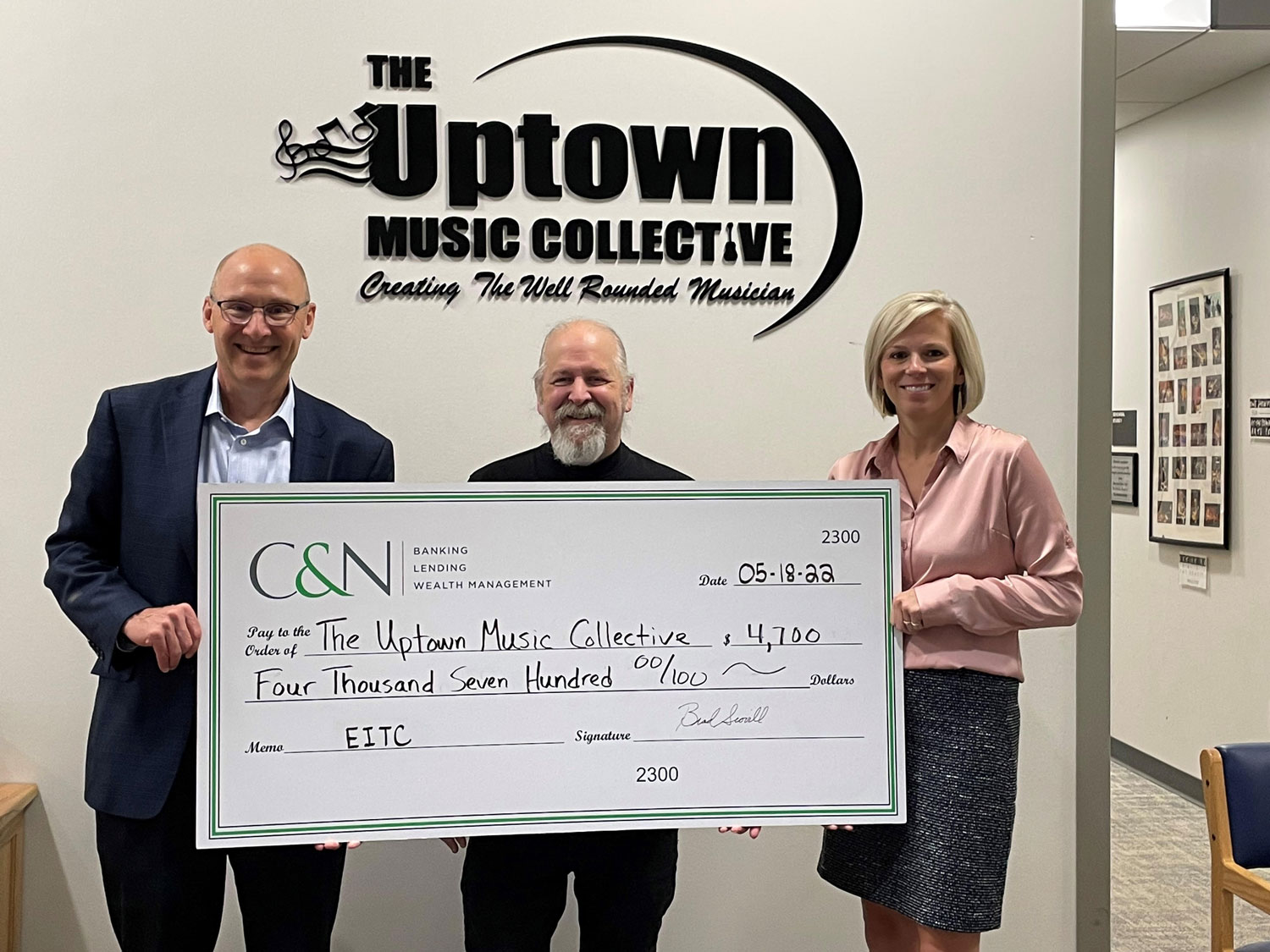

Uptown Music Collective receives a $4,700 donation from C&N.

The Uptown Music Collective received a $4,700 donation from C&N as part of the Educational Improvement Tax Credit (EITC) program. Pictured, from left, are Tom Rudy, Jr., C&N’s EVP/Chief Delivery Officer & Region President; Dave Brumbaugh, UMC’s Executive Director; and Rachael Clark, C&N’s VP/Regional Retail Market Leader.

2021

Woodlands Bank Donates $5,000 to Uptown Music Collective through EITC Program.

The Uptown Music Collective received a $5,000 donation from Woodlands Bank as part of the Educational Improvement Tax Credit (EITC) program. “We are so grateful for the continued support of Woodlands Bank for our youth-oriented music education programs through this EITC program donation,” said Dave Brumbaugh, Executive Director of the Uptown Music Collective.“ Pictured, from left, are Joe Farley, CFO, Woodlands Bank; Dave Brumbaugh, Executive Director, Uptown Music Collective; Adrienne Wertz, Development Coordinator, Uptown Music Collective and Jon Conklin, President & CEO, Woodlands Bank.